How to get a GST Registration Number?

Before you start the registration process, ensure your business meets the eligibility criteria. Generally, businesses with an annual turnover exceeding Rs. 20 lakhs (Rs. 10 lakhs for special category states) must register for GST. However, certain businesses, like e-commerce operators and those engaged in inter-state trade, may need to register regardless of their turnover.

In this article, we will provide a step-by-step guide on how to get a GST number in India.

Gather Required Documents and Information

Before you begin the registration process, ensure you have the following documents handy:

Aadhar card: Your Aadhar card is your identity proof.

PAN card: The Permanent Account Number (PAN) is mandatory for all individuals and businesses.

Address proof: This can be a utility bill, passport, or rental agreement.

Bank account details: A canceled cheque or bank statement.

Business registration documents: If you're a company or partnership, have your registration certificate handy.

Different Types of GST Registration

Under the GST Act, GST Registration can be of various types. You must be aware of the different types of GST Registration before selecting the appropriate one. The different types of GST Registration are:

Normal Taxpayer:

Most businesses in India fall under this category. You need not provide any deposit to become a normal taxpayer. There is also no expiry date for taxpayers who fall under this category.

Casual Taxable Person:

Individuals who wish to set up a seasonal shop or stall can opt for this category. You must deposit an advance amount that is equal to the expected GST liability during the time the stall or seasonal shop is operational. The duration of the GST Registration under this category is 3 months and it can be extended or renewed.

Composition Taxpayer:

Apply for this if you wish to obtain the GST Composition Scheme. You will have to deposit a flat under this category. The Input tax credit cannot be obtained under this category.

Non-Resident Taxable Person:

If you live outside India, but supply goods to individuals who stay in India, opt for this type of GST Registration. Similar to the Casual Taxable Person type, you must pay a deposit equal to the expected GST liability during the time the GST registration is active. The duration for this type of GST registration is usually 3 months, but it can be extended or renewed at the type of expiry.

Eligibility to Register for GST

GST Registration must be completed by the following individuals and businesses:

- Individuals who have registered under the tax services before the GST law came into effect.

- Non-Resident Taxable Person and Casual Taxable Person.

- Individuals who pay tax under the reverse charge mechanism.

- All Ecommerce aggregators

- Businesses that have a turnover that exceeds Rs.40 lakh. In the case of Uttarakhand, Himachal Pradesh, Jammu & Kashmir, and North-Eastern states, the turnover of the business should exceed Rs.10 lakh.

- Input service distributors and agents of a supplier.

- Individuals who supply goods through an e-commerce aggregator.

- Individuals providing database access and online information from outside India to people who live in India other than those who are registered taxable persons.

- GST registration is mandatory for businesses that have an annual turnover of Rs.20 lakh and more.

New Online GST Registration Fees

No charges are levied to complete the GST registration process.

In case businesses do not complete the registration process, 10% of the amount that is due or Rs.10,000 will be levied. In the case of tax evasion, 100% of the amount that is due will be levied as a penalty.

Once the relevant documents have been uploaded, an Application Reference Number (ARN) will be sent via SMS and email to confirm the registration.

GST Registration Exemption

The below-mentioned individuals and entities are exempt from GST registration:

- Businesses that manufacture supplies that come under reverse charge.

- Activities that do not come under the supply of goods or services. Examples of such activities are the sale of a building or land, funeral services, and services provided by an employee.

- Businesses that make non-GST/ non-taxable supplies. Examples are aviation turbine fuel, electricity, natural gas, high-speed diesel, and petrol.

- Businesses that make exempt/ nil-rated supplies.

- Businesses that fall under the threshold exemption limit.

- Agriculturists.

Features of GST Registration

Some of the features of GST registration are as follows:

- GST registration is PAN-based and state-specific.

- An individual who is registered in one state is termed an ‘unregistered person’ in another state.

- Suppliers must register in every state or union territory from which they supply services.

- In case a person owns a unit in a Special Economic Zone (SEZ) or is a SEZ developer and also owns a unit in a domestic tariff area (outside the SEZ) within the same state, they must register the SEZ unit separately.

- All registered people are expected to display their registration certificates and GSTIN at their primary place of business and also at every additional business location.

- A particular PAN-based legal organization will have one GSTIN per State, which implies that a business company with branches in many states would have to register separately in each state. However, a person with several business locations in a State or Union territory may be given a separate registration for each location.

- GST registration is not tax-specific, which implies that there is just one registration for all taxes, including IGST, CGST, SGST/UTGST, and cesses.

Benefits of GST Registration

- Eliminates the Cascading Effect of Tax: GST's comprehensive nature intends to avoid the cascading tax impact. The cascading effect refers to a tax on tax in which the tax liability was transferred at each level of the transaction. Due to this, the cost of the item increases. GST eliminates this cascading effect since the tax has a direct impact on the price of goods and services.

- Transparent in Nature: GST is a transparent tax system with no costs or hidden charges for registered retailers. This makes the expenses involved in business lesser.

- Tax evasion: The input credit is accessible to the receiver if the supplier includes the data in its return. This encourages the suppliers hence reducing tax evasion.

- Composition Schemes for Small Firms: Many small businesses are now under less of a tax and compliance burden. Additionally, small firms, defined as those with a turnover of Rs.20 lakh to Rs.75 lakh might profit from the use of composition schemes.

- Higher Registration Threshold: Under previous tax laws, businesses with an annual turnover of more than Rs.5 lakh were subject to VAT. Various states had different limits. However, in the GST system, the threshold is raised to Rs.20 lakh thereby exempting small businesses and service providers.

- Reduced Number of Compliances: Previously, each tax had its own returns and compliances. However, the compliances have decreased after GST was implemented. There is only one unified return that must be filed.

- Treatment Guidelines for Online Merchants: The e-commerce industry had no established definition of the supply of goods prior to the introduction of GST. A few states would view these as mediators or facilitators, exempting them from the need to register for VAT. The GST has eliminated all of these unequal treatment practices.

- Unorganised Sector is Regulated: The textile and construction industries were mostly disorganized and unregulated. Online compliance and payment options are covered by the GST. Therefore, these industries will now be held accountable and regulated.

- Improvement in logistics Efficiency: Due to the GST, which has reduced obstacles to the free movement of goods between states, logistics efficiency has grown. Warehouses are choosing to locate their units in major cities rather than any other location.

Benefits of GST registration for composition dealers, normal registered businesses, and businesses who opt for GST registration voluntarily?

- The benefits of registering under GST for composition dealers are that the impact on working capital reduces; tax liability decreases, and limited compliance.

- Benefits for normal registered business are that it allows interstate business without restriction and takes input tax credit.

- For the businesses who opt for GST registration voluntarily the benefits are a competitive advantage over other businesses; enables taxpayers to avail themselves of input tax credit; allows easy registration on online and e-commerce websites; and allows interstate business transactions without restriction.

Online Registration

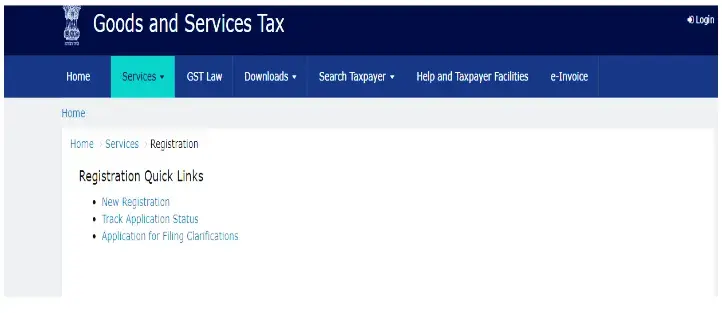

Step 1: Visit the GST Portal

Go to the official GST portal by typing "www.gst.gov.in" in your web browser.

Step 2: Click on "Services"

On the GST portal homepage, click on the "Services" tab as shown below.

Step 3: Select "New Registration"

After clicking on the "Services" tab. Under "Services," select "Registration," and then click on "New Registration"

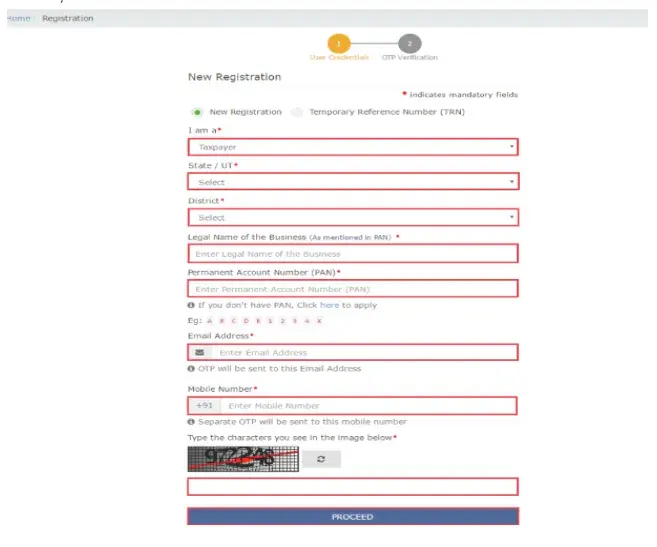

Step 4: Fill in the Details

After that, you'll need to fill in your basic details such as your business name, PAN number, email address, and mobile number. After filling in the details, click on "Proceed".

Step 5: Upload Documents

Upload the scanned copies of the required documents mentioned earlier. Make sure the documents are clear and legible.

Step 6: OTP Verification

After verification, you will receive an OTP (One Time Password) on your registered mobile number and email. Use this OTP to electronically sign the application.

Step 7: Verification

After submitting the application, a unique Application Reference Number (ARN) will be generated. You will receive this ARN on your registered mobile and email. This number is important for tracking your application's status.

Step 8: Verification by Tax Authorities

Once you submit the application, it will be verified by the GST department. They may ask for additional documents or information if required.

Step 9: GSTIN Allocation

After successful verification, you will receive your Goods and Services Tax Identification Number (GSTIN). This 15-digit number is your gateway to the world of GST compliance.

Step 10: Start Filing Returns

Congratulations, you now have your GST number! It's time to start filing your GST returns regularly to stay compliant.

FAQs on Online GST Registration Process

1. Is GST registration mandatory?

Yes, GST registration is mandatory and should be obtained by the taxpayer if the business turnover exceeds the threshold limit.

2. Can I get multiple GST registrations within a state?

Yes, you can apply for multiple GST registrations for the same business within a state. Only GST registration for different businesses within a state has been removed.

3. Who can register for the composition scheme under GST?

The Composition scheme can be opted for by the small taxpayers who want low tax rates under GST and lesser compliance. A business with an aggregate turnover below Rs 1.5 crore and Rs.75 lakh for North-eastern states and Himachal Pradesh, can be applied for composition scheme under GST.

4. Is GST registration free?

Yes, GST registration can be done online at Nil charges.

5. What is the deadline for registering under GST?

A business that is required to register for GST must apply for registration within 30 days after satisfying the criteria. Prior to starting a company, casual taxpayers and non-resident taxpayers must register for GST.

6. How long is a GST registration valid?

There is no expiration date for a GST registration. Thus, it remains valid until surrendered, suspended, or canceled. Only non-resident taxable individuals and casual taxable individuals have a validity term that is set by the authorities when the GST registration certificate is issued.

7. Is an individual who does not have a GST registration allowed to collect GST?

No, GST can be collected only by those who have registered for GST. Individuals who are not registered for GST are not permitted to claim an input tax credit for GST paid.

8. When will I receive my GST number?

The complete GST registration procedure, including receiving the GST number, takes 7 to 10 working days.

9. Can I do two GST registrations using the same PAN card?

No, it is only valid for one registration. However, you may add multiple businesses during the GST registration process.

10. What happens when the GST registration is completed?

You will receive a GST registration certificate as well as a valid GSTIN after the GST registration procedure has been completed. You are now entitled to file GST returns and claim the input tax credit.

11. My company has locations in two states. Do I have to register individually for GST in these states?

Yes, you must register for GST separately in each of the two states where your company conducts business.

12. What if the GST application is rejected?

If your GST application was rejected, you will be given the opportunity to respond to the rejection letter. However, if you desire to reapply, you must first wait for a final rejection which may take about 10 days.

13. What is the threshold limit for GST registration?

Businesses that sell goods and have a turnover of more than Rs.40 lakh (or Rs.20 lakh in the northeastern and hill states) must register as regular taxable persons. The threshold in the case of service providers is Rs.20 lakh (Rs.10 lakh for northeastern and hill states).

14. Are exported goods and services subject to GST?

No, there is no GST levied on exported goods and services. GST is a tax imposed on consumption, and as goods and services exported are not consumed in India, they are not subject to tax.

15. Is a bank account mandatory for GST registration?

No, The bank account is not mandatory at the time of GST registration.

16. How much does a GST number cost?

The government does not charge you any fees when it comes to registration for GST. However, if you approach a chartered accountant or consultant, they may charge you a professional fee as the entire registration process is a tedious one.

17. Can I surrender my GST number?

Yes, you can surrender the GST number. However, you can do so only after one year from the date of registration.

Conclusion

Getting a GST Number is a Crucial Step in India to start your business. It is not just about complying with tax regulations, it's about empowering your business to thrive in a complex and competitive world. By following these steps and ensuring that you have all the required documents in order, you can smoothly navigate the registration process and begin your journey toward GST compliance. It's advisable to seek professional guidance or consult with a GST expert, get your GST number today and set your business on the path to success!!!