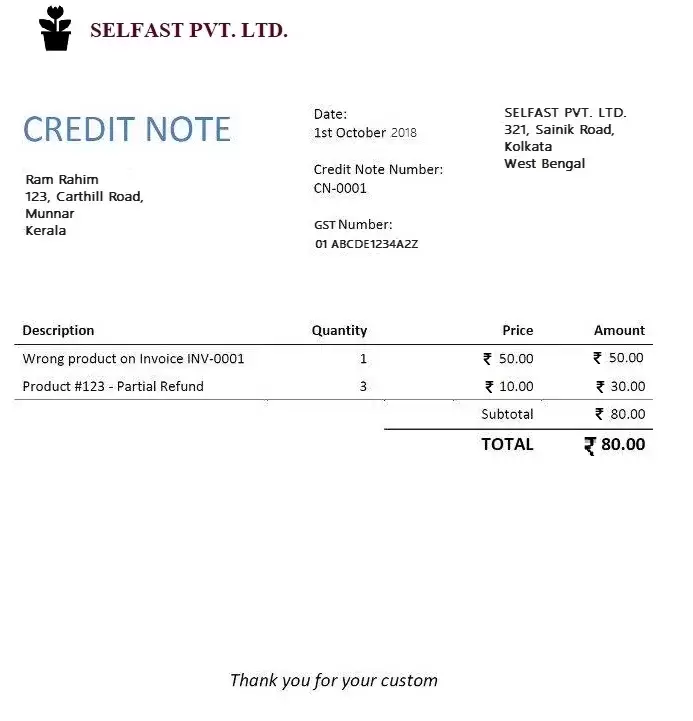

Franchise return can now be treated as GST Credit Note

Till date, franchise return was treated as inward supply only, i.e., only the GST input account got impacted. But with this update, now GST credit note can be issued impacting the GST output ledger. The provision has been created as GST law/rules now allow single/consolidated credit note against multiple invoices.

The user will have to select GST credit note type numbering scheme in order to issue a GST credit note.

Note: Previously when GST credit note numbering was selected, managed franchisee sites/stores were not shown in the list to be selected.

Please note that Ginesys allows only 1 Sales Return transaction against 1 Goods Return transaction from managed franchisee store.

Here are a few important system behaviour scenarios related to that -

- All items get set-off with invoices, i.e., no adhoc item exists: System will allow to proceed as GST credit note.

- Only some items get set-off with invoices, i.e., few adhoc (no invoice set-off) item exists: System will ask the user to convert this transaction to inward supply (as treated earlier).

- All items are adhoc, i.e., no invoice set-off: System will allow GST credit note transaction & treat this as a migration (new Ginesys implementation) case but will not allow release of transaction until original invoice details are specified in doc number/date fields of the transaction. GST Returns have to be handled manually.

Even though GST law has allowed a consolidated credit note, GST Return portals / API are not yet updated with the said changes. So GST Returns will have to be handled manually and Ginesys recommends discussing how to handle the same with your accountant.